Published

2020-09-25

How to Cite

Lolo, T. F. (2020). Upaya Hukum Penyelesaian Sengketa Nasabah Terhadap Bank Yang Mengalami Perubahan Sistem Operasional Perbankan. Al Qodiri : Jurnal Pendidikan, Sosial Dan Keagamaan, 18(2), 454-461. Retrieved from https://ejournal.kopertais4.or.id/tapalkuda/index.php/qodiri/article/view/3922

Section

Articles

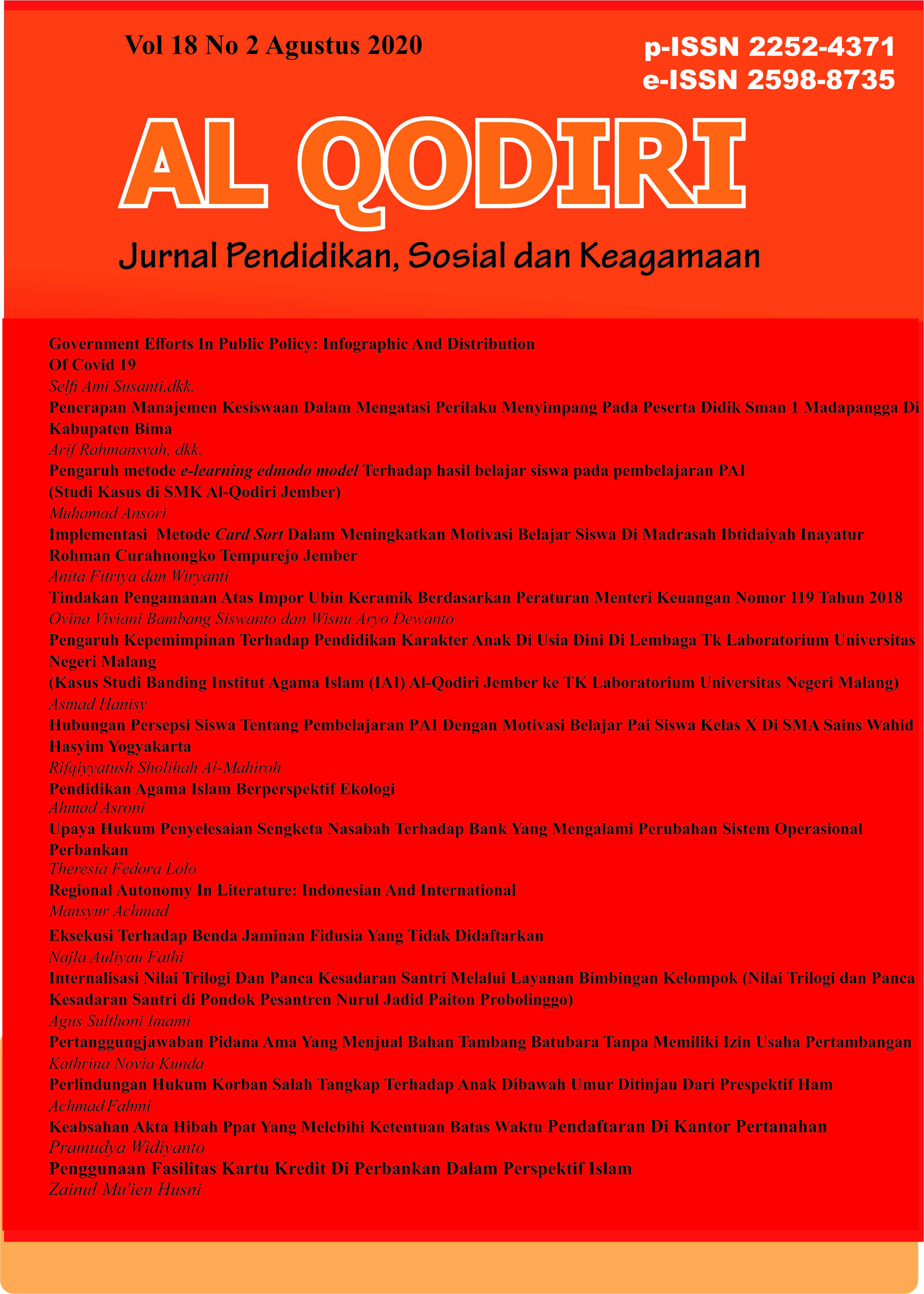

Al Qodiri : Jurnal Pendidikan, Sosial dan Keagamaan

Acredited in 2020-2024: SINTA 5: Sertifikat

ISSN (Printed ISSN) 2252-4371

ISSN (online) 2598-8735

Email Journal:

jurnalalqodiri@gmail.com

ABOUT THIS JOURNAL:

Editorial Team

Focus and Scope

Peer Reviewers

Periode of Publication

Open Access Statement

Publication Athic

Article Processing Charge

Plagiarism Check

License Term

Histori Jurnal

Author Guidelines

Online Submission

Contact

TOLLS:

Language

Information

Al Qodiri : Jurnal Pendidikan, Sosial dan Keagamaan

Institut Agama Islam Al-Qodiri Jember

Jln. Manggar Gebang Poreng 139A Patrang Jember Jawa Timur

Email Jurnal: jurnalalqodiri@gmail.com

This work is licensed under a Creative Commons Attribution 4.0 International License.